Form 8936: Maximizing Your Tax Credit for Plug-In Electric Vehicles

Dec 13, 2024 By Aldrich Acheson

With electric vehicles (EVs) gaining popularity, more people are looking for ways to make the switch affordable. If youve considered purchasing a plug-in electric vehicle, then Form 8936 might be your new best friend. This form helps EV buyers get a tax credit that reduces the amount of taxes they owe based on their electric vehicle purchase.

But what is Form 8936, and how do you maximize its benefits? First-time electric car purchaser or just looking to learn more about it? Check out this post where everything you need to know about Form 8936 and the Plug-In Electric Drive Motor Vehicle Credit is broken down.

What is Form 8936?

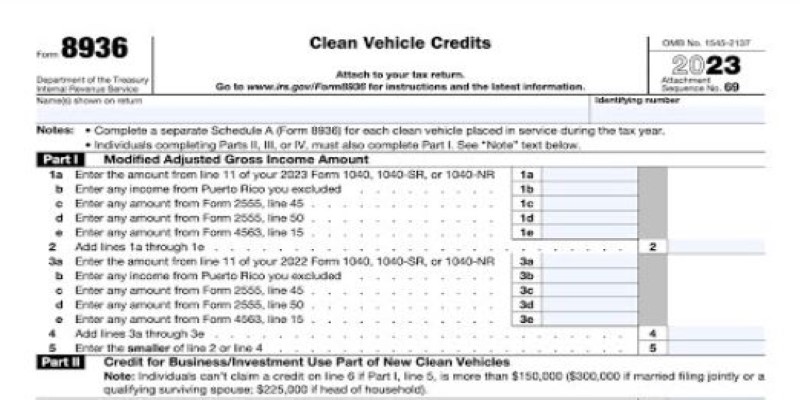

Form 8936, formerly known as the "Qualified Plug-In Electric Drive Motor Vehicle Credit," is an IRS form that allows a taxpayer to claim a credit on a qualified electric vehicle. The idea behind this credit is to encourage people to buy green vehicles and, therefore, to help them achieve a cleaner switchover away from the usual gas-guzzling cars.

When you file Form 8936 with your federal tax return, the credit can directly reduce your tax liability. In simpler terms, it can lower the amount of federal income tax you owe. Depending on the specifics of the vehicle and certain eligibility factors, the credit can be substantial, making the cost of purchasing an EV much more manageable.

Who Qualifies for the Form 8936 Credit?

To qualify for the credit on Form 8936, there are requirements both on the vehicle and on the taxpayer. The vehicle qualifies as a new, four kilowatt-hours capacity, plug-in electric automobile model acquired for use inside the United States and not leased. This qualification only allows new electric, qualified vehicles used in the United States to qualify.

Income limitations also affect eligibility. For 2024, the IRS has set income caps, meaning higher-income taxpayers may see their credit reduced or entirely phased out based on their income and filing status (single, married, filing jointly, etc.). This income phase-out varies, so checking the latest IRS guidelines before applying for the credit is crucial to understanding your eligibility.

Business owners, including corporations and partnerships, can also claim the Form 8936 credit if they buy qualified electric vehicles for business use. This makes it advantageous for companies transitioning to a greener fleet. While the same vehicle and usage criteria apply, business taxpayers must follow specific steps to incorporate the credit into their returns. Form 8936, therefore, provides both individuals and businesses a valuable incentive to embrace clean energy transportation solutions, potentially lowering tax liabilities while supporting environmental goals.

How Much is the Plug-In Electric Vehicle Credit Worth?

The amount you receive as a credit largely depends on the specific make and model of the vehicle. For qualified plug-in electric vehicles, the credit can range from $2,500 to $7,500. However, the credit amount is calculated based on the vehicles battery capacity; cars with larger batteries tend to qualify for a higher credit.

For example, a plug-in hybrid with a smaller battery might only be eligible for the minimum credit. In contrast, a fully electric vehicle with a large battery pack could yield a maximum of $7,500 credit. Additionally, there is a phase-out rule based on how many vehicles a manufacturer sells. Once a manufacturer sells over 200,000 eligible plug-in electric vehicles in the U.S., the credit begins to phase out for buyers of that manufacturer's vehicles. Companies like Tesla and GM, for instance, have already passed this limit, so their newer models may not qualify for the full or any credit.

Step-by-Step Guide to Filling Out Form 8936

Here's a detailed, step-by-step guide to filling out Form 8936 to claim the Plug-In Electric Drive Motor Vehicle Credit. This process helps you ensure accuracy when claiming this valuable tax credit.

Personal and Vehicle Information:

Begin by entering your name and Social Security number, then proceed to the vehicle details section. Here, include essential information about your electric vehicle, such as the make, model, and VIN (Vehicle Identification Number). Accurate entries in this section help the IRS verify your eligibility for the Plug-In Electric Drive Motor Vehicle Credit.

Calculate the Credit:

In this step, determine the exact credit amount youre eligible for by referencing the vehicles battery capacity. Many manufacturers provide credit estimates for their models, simplifying this calculation. The credit ranges from $2,500 to $7,500, depending on the battery size and other factors. Ensuring accuracy here maximizes your tax credit potential.

Add to Your Return:

After calculating the credit, transfer the amount to the Other Credits section of your federal tax return. This step is essential because it directly reduces your overall tax liability, which can significantly lower what you owe the IRS. Make sure this is done correctly to reflect the credits full impact.

Attach to Your Return:

Attach Form 8936 to your tax return when filing. This inclusion is mandatory for the IRS to process and validate your credit claim. Without this attachment, your credit application may be delayed or denied. Confirm all documentation is in order before submission to avoid complications.

Conclusion

Form 8936 offers a valuable opportunity for taxpayers to save when purchasing a plug-in electric vehicle, making sustainable transportation options more accessible to the average consumer. By understanding the qualification criteria, calculating the credit accurately, and timing your purchase wisely, you can maximize the financial benefits of going green. While navigating tax forms may seem complex, the potential tax savings, along with the environmental impact, make the effort worthwhile. So, if youre considering joining the electric vehicle revolution, make sure Form 8936 is part of your journey to a cleaner, more sustainable future.