How to Begin Transferring Money Internationally

Dec 11, 2024 By Georgia Vincent

Do you have to make an international money transfer? Whatever your reason for doing so, be it sending money to family residing abroad, paying for a certain service, or expanding your business, conceptually understanding international money transfers is going to help.

Understanding International Money Transfers

International money transfer has formed an integral part of this globalizing world. Whether you send funds to family residing abroad, pay fees for overseas education, or conduct business, knowing how this works is essential.

What is an International Money Transfer?

An international money transfer, better known as a remittance, is transmitting money across national borders from one country to another. This could be between bank accounts, online platforms, or through special money transfer services. It simply crosses national boundaries and can include currency conversion.

How Does It Work?

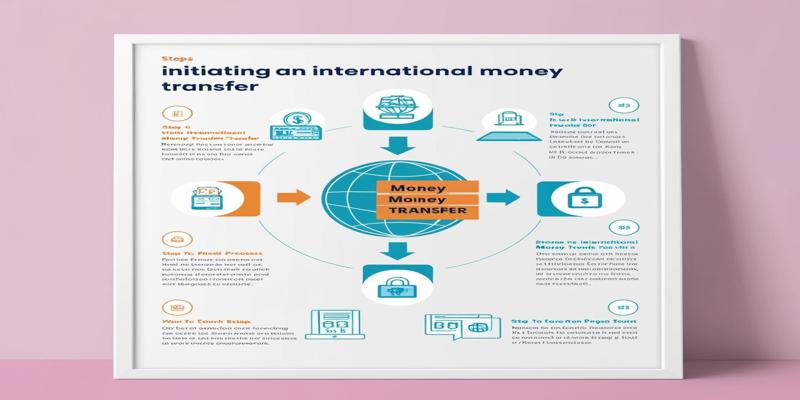

It typically works in a few stages:

- Initiation: The sender discloses information about the recipient and the amount he intends to transfer.

- Conversion: The sent currency is converted to the receiver's currency if necessary.

- Transfer: Cash is transferred through various banking networks or transfer systems.

- Receipt: The transferred amount of cash is deposited in the account holder's account.

Choosing the Right International Money Transfer Service

When sending money internationally, you must choose the proper service. This guarantees that your deal will be faster, less expensive, and highly secure.

Comparing Fees and Exchange Rates

First, compare the fees each provider charges. While some may be low because of low upfront costs, they may compensate by offering less favorable exchange rates. Seek out services that are very transparent about their prices, then charge competitive rates. Remember, the best deal isn't always the cheapest option-consider the overall value, including transfer speed and customer support.

Evaluating Transfer Speed and Convenience

Consider how fast you need the money to arrive at a destination. Though some services offer virtually instant transfers, others take several business days. You will want to balance the urgency of your transfer with the cost since faster options invariably bear higher fees. In addition, consider how convenient it will be for you to use the service. Easy-to-use mobile apps and seamless web interfaces can make life much easier, especially if you send money regularly.

Assessing Security and Reliability

Moreover, focus on services that will ensure the safety of your financial information and the transfer of money to an appropriate recipient. Check if the company is licensed and regulated in home and destination countries. Check the company history and customer reviews for things such as lost transfers or disputes. More importantly, the customer care support system is critical to a smooth transaction without emotional headaches.

Getting Started with Your Transfer

Choose Your Transfer Method

When you are sending money across the borders, you have to select a transfer method. Banks give you traditional wire transfer options, which are safe but highly-priced. Most online cash transfer services offer superior exchange rates and faster processing times. You will have to decide how fast you need the transfer delivery, how much the whole deal cost you, what exchange rate will be applied, and your recipient prefers what method to get their cash.

Gather Necessary Information

Before proceeding with your transfer, collect all required details. This typically includes:

- Recipient's full name (as it appears on their ID)

- Recipient's bank account number or IBAN

- Bank's SWIFT/BIC code

- Recipient's address

- Purpose of the transfer

Compare Rates and Fees

Shop around and compare the exchange rates and fees among different providers. Be aware of hidden costs that may be added in such situations-intermediary bank fees or receiving charges. Check if one qualifies for any promotional offers, such as guarantees on the current exchange rate or no fees for your first transfer, which can be availed of to get total value for money on the proposed transfer. Note that cheap is only sometimes the best. Consider reputation and customer service.

Completing the Transfer Process

Initiating Your Transfer

Log in to your online account on the provider's website with which you have decided to carry out your international money transfer. Click on the 'Make a Transfer' option and select the recipient's country. Enter the transfer amount, keeping in mind any minimum or maximum limit, if applicable. The exchange rate and fees will automatically appear on the screen, which you can use to double-check the total cost before confirming.

Providing Recipient Details

Now, carefully fill in the details about your recipient: his full name, address, and bank account details. Some countries will also need an additional SWIFT code or IBAN. Double-check all entries to avoid any delays or failed transfers.

Choosing Payment Method

Choose your payment method. This could be a bank transfer, debit card, or credit card. Note that each of these methods can be completed in different hours and days depending on the fee applied. Therefore, these are some things to consider.

Reviewing and Confirming

Review all of your transfer details before completing the process. Ensure that the recipient information, the amount, the exchange rate, and the associated fees are correct. Most providers provide you with a summary page to review in detail. If everything seems right, confirm your transaction and complete any necessary security steps, such as entering a verification code.

Tracking Your Transfer

Upon confirmation, you will receive a Transaction ID or reference number to trace the status of your transfer through the provider's online platform or customer service. Most transfers go through between 1 to 5 business days, depending on the countries and methods involved.

International Money Transfer FAQs

What is the safest way to transfer money internationally?

Safety is paramount when it comes to international money transfers. The most secure ways of transferring money usually include using established banks or reputable online transfer services. Such organizations use advanced security features, such as encryption and fraud detection systems, to help protect your money and personal information.

How long does an international money transfer take?

It is tough to estimate because it depends much on the method and destination. Usually, bank-to-bank transfers via SWIFT take 1-5 days, though some online money transfer services offer more urgent variants, which will deliver your money in minutes or hours.

Are there any hidden fees in international money transfers?

While reputable services go a long way toward ensuring that everything is transparently presented, it is always important to be aware of any hidden costs. These can be unattractive exchange rate markups, intermediary bank fees, or receiving bank charges.

Conclusion

Conclusion In today's globalized world, money transfers internationally are necessary. By the end of this guide, you should have gained confidence in transferring your money abroad. Remember to compare providers, read between the lines regarding their fees, and ensure the security of the entire transfer process.