Learn: What is Delivered Duty Unpaid (DDU)?

Feb 18, 2024 By Susan Kelly

Introduction

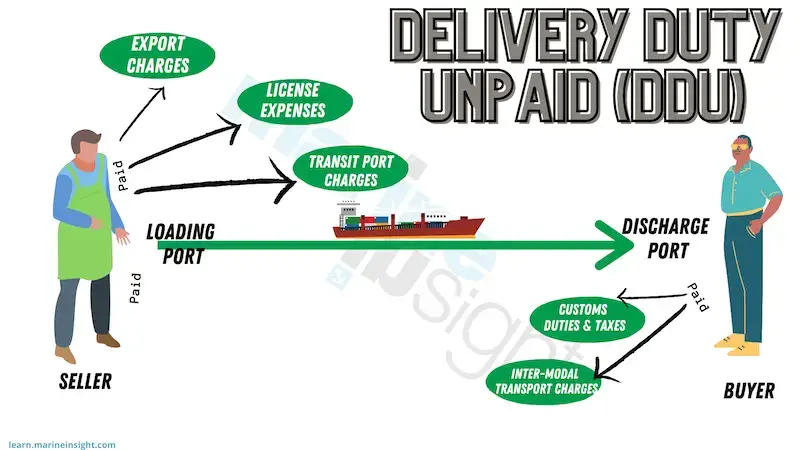

What is delivered duty unpaid (DDU)? DDU International traders use the term "delivered duty unpaid" (incoterm) to indicate that the vendor intends to deliver goods as soon as they are available at a predetermined location in the country from which they are being shipped. For the most part, DDU means sellers are responsible for all costs and logistics until the item is delivered to the agreed-upon destination and is exempt from customs or import duties. In the case of exports, the seller is responsible for the costs and licensing. For imports, the buyer bears the costs and licensing fees.

Delivered Duty Unpaid (DDU)

The International Chamber of Commerce established international trade rules in the wake of World War I to promote prosperity across Europe. There are contracts known as Incoterms that specify who is responsible for international business transactions regarding risk and expense. They can be changed at the ICC's discretion. The International Chamber of Commerce (ICC) is working to standardize its rules to reduce the administrative and legal burden on businesses.

How Does Delivered Duty Unpaid (DDU Shipping) Work?

Under the DDU shipping term, the seller must deliver the goods to the agreed-upon destination within the importer's country. The buyer is responsible for all the costs and shipping for items that haven't been pre-arranged. Taxes, fees, and charges are all included in this.

What's the Distinction Between DDU and DDP?

Even though DDU is the most common option, some sellers may use DDP. The DDP model. DDP is an abbreviation for Delivered Duty Paid, which is what the acronym stands for. Because DDP sellers must pay customs or import duties in addition to the costs of export like DDU sellers, the difference is significant. There may be additional taxes or fees that must be paid.

In a more complex manner. We could say more formally that ultimately, it is up to the seller to carry the weight of the transaction. They are responsible for the cost of shipping the goods to the buyer's doorstep. With little or no responsibility for the delivery process, sellers benefit from their products and pass that benefit on to their customers. To put it another way, in DDU, The seller pays delivery costs, and then the customer assumes responsibility for the package once it reaches its destination. This is a win-win situation for everyone involved because everyone is held accountable to the laws of the country they call home.

Advantages and Disadvantages of Delivered Duty Unpaid (DDU)

Greater control over the shipping process can be crucial for buyers worldwide who want to ensure a constant supply of goods.

Delivered Duty-Free (DDU) Shipping's ability to track shipments is another advantage. It is much easier to follow a package while it is still in the hands of the sender than it is once it has left the country of origin. This means that the seller can track the item until it reaches its final destination, after which the buyer has complete control over when and where the item is shipped and taken away from the seller's control.

DDU shipping has a few drawbacks. When a shipment is delivered, one of the biggest worries for purchasers is the possibility of additional taxes or duties. This is a severe issue for consumers. The problem for shippers is that angry customers may refuse to pay for the package delivery.

Delivered at Place (DAP) and Delivered at Place Unloaded (DPU)

Incoterms(r) 2020, the ICC's most recent publication, For this reason, DDU has been replaced by DAP (Delivered at Place) in the most recent publication of the International Chamber of Commerce (ICC). Another term that has been dropped in favor of DAT is DAT (Delivered by Terminal). DAT has been replaced by DPU (Delivered at the Place where it is unloaded) to make it clear that unloading does not have to take place at the terminal.

Two Incoterms(r) similar to DDU are DAP and DPU. Delivered to Place is abbreviated as DAP, and Delivered to Place Unloaded is abbreviated as DPU. The buyer must pay taxes and customs duties and unload the shipment in a DAP transaction. Carriage and delivery of the goods are arranged by the seller and delivered to a designated location. DAP can be used to negotiate transportation contracts for any transport.

Conclusion

Import taxes are the purchaser's responsibility, but the dealer is accountable for safely delivering the goods to their destination. This is known as "Delivered Duty Unpaid" (DDU). In transport contracts, DDU is still used; however, delivered-at-place has now been officially adopted as its replacement by the International Chamber of Commerce (DAP). Because of this, the most significant benefit of DDU shipping is that buyers have more control over the shipping process. Regarding shipping regulations in the destination country, the seller can take a more "hands-off" approach when using DDU shipping. DDU shipping buyers face the most significant risk of being hit with unexpected duties or tax fees when their package arrives at its destiny